Utah and Nevada Solar Power Incentives & Rebates

State and federal tax credits make significant solar panel incentives, but there are several ways to save money with solar, including the Utah power rebates we’re afforded by private companies and organizations.

Solar tax credits and incentives contribute to a stronger ROI because federal and state credits cut down 30 – 50% of the cost of going solar. Find out how much your true ROI will be before you make the move to go solar.

The average American household takes out a loan to finance a solar array, so Go Solar Group’s initiative is to make solar affordable for any lifestyle. In order to do so, we have assembled a comprehensive list of solar tax incentives and solar rebates to help you convert to solar energy at an affordable rate.

This guide will explain state and federal solar tax credit forms, private businesses that refund or credit for energy purchases, Go Solar Group’s process for preparing and filing tax forms, and Go Solar Group’s internal opportunities for saving money on your solar purchase.

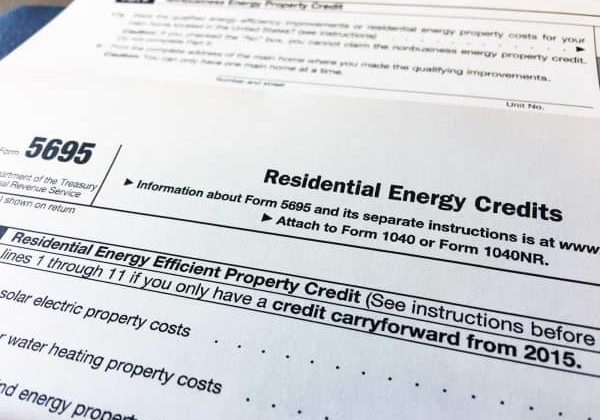

State and Federal Solar Tax Credits

The Benefits of Becoming A Go Solar Group Customer

What We Do for Your Solar Tax Preparation

We prepare all documents: As a full-service solar company, specialists at Go Solar Group will work with you throughout the entirety of your solar installation. Included in the timeline is one-to-one contact with the project manager, who will help you accurately complete the state and federal tax forms associated with your solar purchase. While it may seem like an easy task, not all solar costs are applicable for tax credit, so it is imperative to total all property costs accurately.

We offer a 12-month, no interest, no payment loan: The last thing you want to do is pay unnecessary interest on a large purchase. We are so confident in the tax incentive program supported by state and federal government that we are willing to offer no interest, no payments for 12 months on the 30% tax credit amount to each Go Solar customer. This will save each Go Solar Group customer hundreds of dollars as long as it is paid off within 12 months.

Keep in mind, Go Solar Group does not file your tax documentation with the state and federal government. Once the paperwork is filled out, you’ll need to file it yourself or consult with your tax preparer in order to receive the tax benefit of going solar.

The Sun Share Club: Make money on every referral

Every Go Solar Group customer becomes a Sun Share Club member with the ability to pass on solar discounts to friends, family, and colleagues. In fact, we take all the work out of your referral process so that you can start referring immediately. We will pay you $1,000 for your first referral and $500 for every referral subsequently.

Upon becoming a Sun Share Club member, you will receive a welcome packet full of opportunities to help network via social media and email. We have even put together resources for a discount program at work to refer your colleagues to go solar. When you do, you receive cash that can be applied to your system payments or to your bank account.

“I love it! I haven’t paid for power since my installation. I recommend Go Solar to everyone who asks me. I even received my tax rebate that covered almost half the cost of the panels. Going solar is a long term investment that is paying me back every month. Thanks, Go Solar!” – Robert, St. George UT

Other Ways to Save Money on Solar

Companies Will Reimburse and Discount Energy-Efficient Purchases

Outside of state and federal solar tax rebates, you can find multiple private companies that support the initiative of energy efficiency. Once your home is set up to convert solar energy, you have the ability to offset usage from electric appliances. Our recommendation: update your appliances and ditch gas!

Listed below are companies that endorse energy efficiency by helping you with the costs associated.

- ThermWise will offer rebates on certain energy products.

- Energy Star will offer rebates and help you locate products locally.

- Rocky Mountain Power offers upgrade energy incentives when buying or updating electric products.

- Rocky Mountain Power also offers LED incentives for those looking to renovate lighting options.

- Salt Lake City Building Services will expedite permitting (saving you time and money) on “Green” building projects.

New Customers

Ready for huge savings on your solar array?

Fill out our ‘request to contact’ form for more information about solar panel tax credits.

Go Solar Group Customers

Need further tax form clarity for your existing deal with Go Solar Group?

Contact our project manager Kate at 801-783-3310

What incentives are available for my Reno solar installation?

Below, you can see the Reno 2017 Settlement information. If you scroll down, you’ll see tranches of 80MW, and how the retail rate (what you get back for what you push onto the grid) adjusts every time the solar industry hits 80 MW of residential solar. For reference, the industry is now in the 1st tranche, and customers receive 95% of the retail rate for what they push back onto the grid.

Assembly Bill 405, which was passed by the Nevada Legislature and signed into law by Governor Brian Sandoval in June of 2017, established new rules for rooftop solar customers with systems under 25 kilowatts who applied for and installed a private rooftop solar system on or after June 15, 2017.

Assembly Bill 405 places all net metering customers in the same rate class as their otherwise applicable group of non-solar customers – meaning they pay the same Basic Service Charge and energy rate.

The NMR-405 rate class treats energy that is produced by the system, but not used on-site by the customer (exported energy) differently than the NMR-G and NMR-A rate classes. NMR-405 customers receive monthly netting of the electricity delivered by NV Energy and the electricity they export to the grid. The excess energy, which is the remaining exported energy after monthly netting is accounted for, is credited an amount based on when their rooftop solar application was received by NV Energy:

| Tier | Capacity | Credit | Credit Period |

|---|---|---|---|

| Tier 1 | 80 megawatts of solar capacity applied for | 95% of the retail volumetric electricity rate, excluding public policy charges | 20 years |

| Tier 2 | 80 megawatts of solar capacity applied for | 88% of the retail volumetric electricity rate, excluding public policy charges | 20 years |

| Tier 3 | 80 megawatts of solar capacity applied for | 81% of the retail volumetric electricity rate, excluding public policy charges | 20 years |

| Tier 4 | All solar capacity applied for following the closure of Tier 3 | 75% of the retail volumetric electricity rate, excluding public policy charges | 20 years |

Send a Message

Oops! We could not locate your form.