How to File Your Federal Solar Tax Credit

Adding residential solar to your home helps the environment. However, it can also save money with the federal solar tax credit, also known as the Investment Tax Credit (ITC). The ITC, as of 2020, covers 26 percent of the cost of solar for those who have taxable income. To get this tax credit, solar customers need to file for it. Below we’ve gone through the steps for this process, so customers can easily file for their solar tax credit form and start saving money.

When to File for Your Solar Federal Tax Credit

The Federal government sends out a new ITC form every year. Make sure you file the solar tax credit form for the year of the solar installation. Typically the federal solar tax credit form for the current year releases by February of the following year. Your accountant or tax software should have this form.

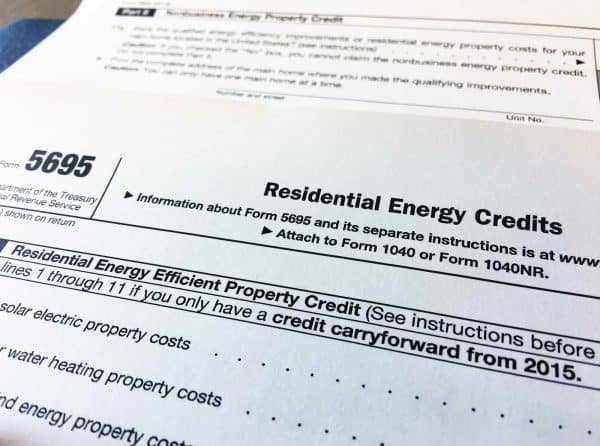

Filling out the IRS Form 5695

When ready to fill out form 5695, make sure it has the correct year in the top right-hand corner of the page. If you had your solar array installed in 2019, the form should appear as it does below.

Once you have the correct 5695 form, it’s time to fill it out. These step-by-step directions should help make the process easier.

- Enter the total cost of your solar array after incentives on line 1 of the form.

- Add the cost of any additional energy improvements to lines 2-4.

- Add all the totals on lines 1-4 and enter them onto line 5.

- Multiply line 5 by the ITC percentage and put the answer on line 6 (for 2020, the ITC percentage equals 26 percent).

- If you aren’t receiving a tax credit for fuel cells or carrying the solar credit from a previous year, add the value on line 6 to line 13.

- Fill out the worksheet on page 3 of the 5695 instructions form to calculate whether you qualify for the full tax credit in one year.

- Enter the results from your calculations to line 14 of Form 5695.

- Put the lesser of the values on lines 13 and 14 on line 15. You can claim the amount on line 15 this tax year.

- If your tax liability equals less than your tax credit, subtract line 15 from line 13 and put this amount on line 16. Line 16 equals the amount you can claim the following year.

How to File Form 5695

Now that you know how much you can claim on your federal taxes, it’s time to file for your solar tax credit. Copy the amount recorded on line 15 of your Form 5695 and add it to line 5 of schedule 3 of Form 1040.

The amount recorded on schedule 3 transfers to line 13b, with the amount on 13a of your 1040 form. To ensure correct filing, a tax professional can complete the ITC for you.

Keep your 5695 in your records along with your TC40 state and federal award letters. These records provide evidence of the year you purchased and installed solar. Proof of your date of install ensures that you can qualify for the correct ITC amount.

Send a Message

Oops! We could not locate your form.